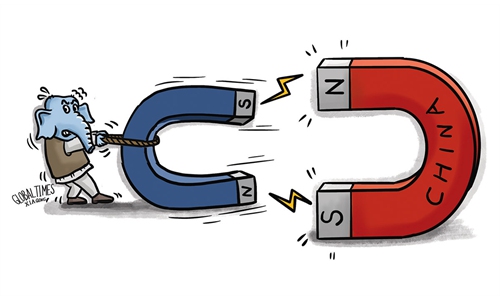

Canada's choice Illustration: Tang Tengfei/GT

Canada's latest move to erect barriers against Chinese mining investment shows that the country is going to extreme lengths in terms of overstretching security concerns into normal economic issues, which sends a negative signal for the future of bilateral mining cooperation and hinders the development of global mineral resources.Jinteng Mining, a subsidiary of Chinese gold and copper company Zijin Mining Group, has sought a judicial review of Canada's decision regarding a Canadian company's sale of a gold mine in Peru, Reuters reported on Sunday.

Jinteng bought Canada-based Pan American Silver Corp's La Arena gold mine in Peru in May for almost $300 million. The judicial review was sought after Canada's Minister of Innovation, Science and Industry François-Philippe Champagne found the agreement "could be injurious to national security" and told the company in late June that he "may" order a formal review, The Canadian Press said.

The Canadian minister's decision embodies the error of overstretching security concepts. It also shows an outdated way of thinking, as if he were still in the era of rampant colonialism, trying to interfere with business activities on a global scale.

As the judicial review application mentioned, the targets are Peruvian entities, and they do not have a place of operations in Canada or otherwise carry on operations in Canada. It seems far-fetched for the minister to arbitrarily associate so-called "national security" issues with a gold mine in Peru, which only exposes his arrogance and hegemonic mind-set. What makes him think that Canada has the grounds or authority to extend its overstretched security concept in countries such as Peru?

Also, the Canadian minister's national security review of the deal is not just legally untenable. It could potentially hinder the normal business operations of mining companies, as well as the maximized development of mining resources in Peru and local economic growth, which would be detrimental to all parties involved.

According to Pan American, it has extended the mine's life from 2021 to 2026, with the potential for a further extension. In South America, mines often have the potential for continued development of other mineral resources after the main mineral resources have been extracted. Thus, after reassessing resource development technology, financial investment, or market strategy, if a company does not consider itself capable of continuing mining, it may consider selling such mines.

In this context, Chinese mining companies are very promising buyers. Chinese mining companies are at the forefront of mining technological innovation. Several Chinese mining companies, including China Minmetals Corp and Aluminum Corp of China, have expanded into the Peruvian market. Their presence has introduced new technologies, enhancing resource extraction efficiency, and significantly boosted the local economy's growth.

The legal dispute is a prime example of Canada rushing to put up key mineral investment barriers in the context of global economic transformation and great power competition.

For a long time, China, as the world's largest consumer and importer of mineral products, has maintained a close cooperation relationship with Canada in the mining field. This was supposed to be a normal trade relationship of mutual benefit, but in recent years, as Washington has promoted the so-called "national security" concept in economic issues, Canada has been a close follower in blocking Chinese companies from investing in overseas mining, casting a shadow over the future of China-Canada mining cooperation.

The self-destructive overstretching of the security concept in the mutually beneficial economic and trade field shows that Canada is seriously politicizing economic issues, which will further damage the reputation and appeal of mining investment in Canada.

If Canada still wants to attract investment for its mining sector, it should be careful about sending signals about geopolitical influences on its mining policy.

For Chinese mining firms, Canada's increasingly tough stance on their investments overseas should remind them to pay more attention to geopolitical risks, to reduce investment uncertainty and protect their own interests.