Illustration: Liu Xidan/GT

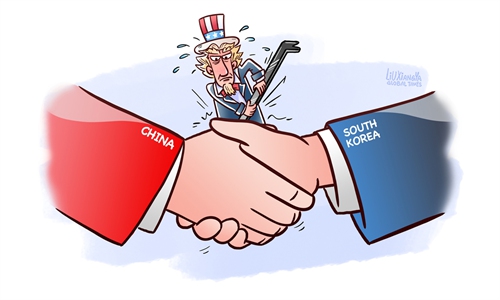

The US is ramping up pressure on South Korea to align with export controls against China, calling for advanced chips like high-bandwidth memory (HBM) models to be provided only to allies, the Korea Herald reported on Wednesday. If the news is true, we advise South Korea to remain sober-minded. It will be a test of Seoul's wisdom to see if it can resist the pressure from Washington and continue to deepen its cooperation with China in the semiconductor sector.South Korea is home to two of the world's largest memory chip manufacturers - Samsung Electronics and SK Hynix, which reportedly hold a combined share of about 90 percent in the global HBM market. If export restrictions are extended to HBM chips, the biggest victim in this whole affair will be South Korea's semiconductor industry.

Political elites in Washington may want South Korea's advanced chips to be sold only to certain countries, and more specifically, only to the US and its allies, which means the export markets for those semiconductors will shrink.

This may have an impact on the supply and demand situation, which in turn will affect the market prices of South Korea's HBM chips, resulting in lower export prices. A direct consequence is that South Korea's semiconductor firms will make less profit from HBM-related business.

HBM technology didn't come out of nowhere. It was built on South Korea's cutting-edge DRAM chip technology. Some South Korean companies have been investing in HBM technology over the past decade. Investment in research and development (R&D) is huge. If the US forces South Korean companies to sacrifice sales and profits for the sake of Washington's strategic selfishness, it won't be much different from directly stealing money from South Korean companies.

Competition in the global semiconductor industry is becoming increasingly fierce. If South Korean companies want to remain competitive, they must be able to earn profits through high-end products. It is perhaps the only way South Korean semiconductor makers will have the motivation to invest in R&D, and their efforts will help strengthen technological innovation and promote the continuous industrial upgrading in the country.

Simply put, HBM is an advanced computer memory made of some DRAM chips vertically stacked together to speed up data processing. For artificial intelligence (AI), it can be a critical component in performance. The US, which aspires to take a leading position in the field of AI, is unlikely to slow down its efforts to grab resources, including but not limited to advanced semiconductors to facilitate its AI development.

South Korea may face growing pressure from the US. However, due to the importance of the semiconductor industry to the South Korean economy, Seoul should resist this pressure and expand exports of its semiconductors to markets including China.

At a time when economic coercion and bullying by the US pose risks, the Chinese economy and market represent great opportunities. South Korea is heavily reliant on China for its semiconductor exports. Some statistics show that about 40 percent of South Korea's chip exports go to China.

The continuous development of trade signals that economic cooperation between China and South Korea in the field of semiconductors is moving toward a comprehensive, multi-dimensional and diversified approach. China is an important production base and sales market for South Korean chip enterprises.

In sharp contrast to Washington's ill-intentioned chip war, China has been exploring a win-win road map with other countries, including South Korea, in terms of semiconductor cooperation. China has always stuck to the principles of fairness, reasonableness, equality and mutual benefit in trade and investment. To exploit economic complementarity between the two countries, South Korea should avoid being held hostage by US export restrictions and Washington's "decoupling" push.

As for China, Washington's chip war has added fresh urgency to the drive for independent innovation. Chinese chipmakers have been ramping up efforts to develop their own AI chips to keep up with the global AI boom.

In the face of potentially fiercer competition, South Korean semiconductor makers need to keep their footholds in China and spare no effort to strengthen cooperation, rather than succumbing to US pressure to sacrifice their own interests.

The author is a reporter with the Global Times. bizopinion@globaltimes.com.cn