China’s central bank cuts existing mortgage rates to prop up housing market, stimulate economic growth

Major moves to prop up nation’s housing market, spur economic growth

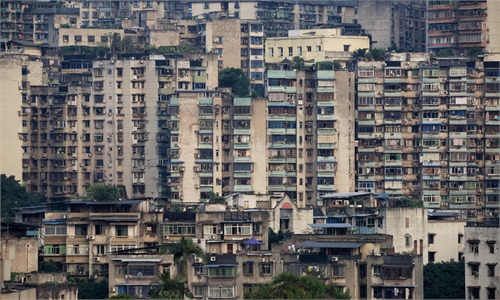

real estate Photo:Xinhua

China's central bank on Tuesday unveiled a new package of monetary measures, led by significant reductions in existing mortgage rates, in a bid to rejuvenate the country's real estate market and fire up consumer spending.

Pan Gongsheng, governor of the People's Bank of China (PBC), announced during a press conference on Tuesday that the central bank will guide lenders to cut existing mortgage rates on home loans by an average of 50 basis points (bps) and lower the minimum down payment for second-home loans nationwide from 25 percent to 15 percent.

These easing measures will have a strong impact on the market, and they are expected to greatly enhance activity by driving up housing transactions during the upcoming peak real estate season in October, contributing to achieving this year's economic growth targets, experts said.

The rate cut is set to benefit 50 million households and 150 million people, leading to an average annual decrease in household interest payments of about 150 billion yuan (equivalent to about $21 billion), Pan said.

Pan emphasized that the move will significantly alleviate homebuyers' financial burdens while spurring domestic consumption and investment to support the stability and growth of the real estate market.

Commercial banks in China will likely continue to lower home mortgage costs in the coming months, as directed by the central bank, market analysts said.

According to market calculations, if mortgage rates are reduced by 50 bps, then the monthly payment on a 30-year mortgage of 1 million yuan, with an equal principal and interest repayment plan, could drop by about 280 yuan, saving about 100,000 yuan in total interest costs during the entire loan period.

The new policy also sets a consistent minimum down payment ratio for loans on both first and second homes. The minimum for second homes has been slashed from the previous 25 percent to 15 percent nationwide, according to Pan.

Among the most impactful mortgage policy changes to date, the measures are expected to drive China's consumer spending and bolster economic growth this year, as the real estate sector remains a vital driver of the Chinese economy, according to Song Ding, a research fellow at the China Development Institute, on Tuesday.

"We will roll out the official documents soon, but banks will require some time to get their systems ready," said Pan, pointing to the PBC's plan to improve the mortgage pricing system, enabling commercial banks and borrowers to adjust terms based on market conditions.

While the down payment for second homes was previously higher than that for first homes, the reduction will help lower the barriers for homebuyers and facilitate second-home sales, Yan Yuejin, deputy director of the E-house China R&D Institute in Shanghai, told the Global Times on Tuesday.