Illustration: Chen Xia/GT

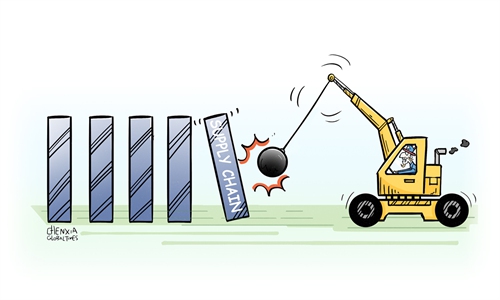

While the US has rallied its allies to form a so-called mineral-security alliance under the banner of "breaking China's grip on supplies of critical minerals," this initiative does little to mask its own ambitions and strategic maneuvers aimed at establishing a global monopoly in key mineral sectors.This politically motivated industrial alliance faces significant challenges, as it must navigate complex issues related to funding, resource allocation and coordination among stakeholders - factors that could easily derail its efforts.

The US announced on Monday the establishment of the Minerals Security Partnership (MSP) Finance Network with its allies, which will be used to "advance diverse, secure and sustainable supply chains for critical minerals," according to a statement released by the US Department of State.

Since the launch of the MSP in 2022, there has been almost no investment, suggesting that despite the political will to enhance supply chain resilience, the translation of this intention into tangible actions remains an unresolved dilemma.

The MSP necessitates not only robust policy support but also substantial financial investment to be effective. However, the US-led critical mineral alliance appears to be an attempt to forcibly restructure the supply chain through nothing more than political will, which fundamentally contradicts established market principles and the natural division of labor within industries.

Even with the political impetus driving these initiatives, the development of critical minerals must adhere to certain commercial logic that cannot be overlooked.

Ultimately, the core issue is not that the US and Western allies lack funds. Instead, it may point to a reallocation of strategic resources aimed at serving their own geopolitical and economic interests, which inevitably leads to increased conflicts over benefits.

Furthermore, economic relationships between Western nations and China are deeply intertwined, with numerous Western companies holding significant stakes in the Chinese market and relying heavily on Chinese supply chains for their operations. Consequently, any attempts to curtail China's mineral investment opportunities in the global market could result in greater losses than gains for these companies, highlighting the complexities and potential repercussions of such geopolitical maneuvers.

While China has emerged as the world's largest producer and exporter of several critical minerals, it is crucial to recognize that it does not hold a particularly advantageous position regarding the endowment of these critical resources.

In recent years, the mineral resources that Chinese companies have sought to acquire overseas sometimes come with risks or uncertainties, which complicates the mining process.

This is largely because control over major global mineral resources remains concentrated in the hands of prominent mining giants from the US and its Western allies. Companies such as BHP Billiton, Rio Tinto and Glencore play pivotal roles in the extraction and trade of various mineral resources on a global scale. These industry leaders possess substantial capital and enjoy technological advantages that empower them to make large-scale investments and undertake extensive developments in resource-rich regions.

Against such a backdrop, Western hype about China's substantial influence over critical mineral sectors that are essential for high-tech industries may only serve as a smokescreen; the underlying reality is that the US and its allies are creating exclusive small circles to assert a monopoly over key minerals. It reminds people of the Western powers' past plunder and competition for global resources over many centuries.

The endeavor by the West to forge a new supply chain that deliberately excludes China is actually resource plundering and hoarding, aimed at consolidating its own geopolitical hegemony.

This approach also signals an impending escalation in competition among global powers for control over these essential assets, with implications for global supply chains, economic stability and environmental sustainability.