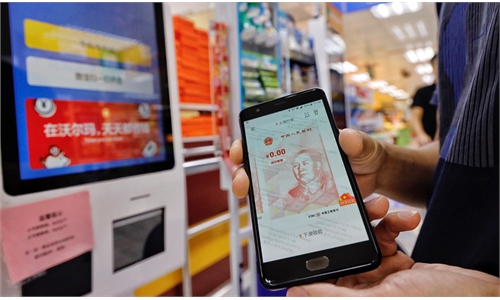

Renminbi Photo: VCG

The People's Bank of China (PBC), the central bank, will support qualified banks from different jurisdictions in participating in the Cross-Border Interbank Payment System (CIPS) for the Chinese yuan, Lu Lei, deputy governor of the PBC said on Monday at the opening ceremony of Sibos 2024.

The CIPS is a Chinese payment system that offers clearing and settlement services for its participants in cross-border yuan payments and trade. CIPS is backed by the PBC and was launched in 2015.

Sibos is the annual conference, exhibition and networking event organized by Swift for the financial industry. Sibos 2024 is being held in Beijing this week, the first time China's capital is hosting the event.

During the opening ceremony, Lu noted that the central bank will continuously improve policies for cross-border yuan transaction, enhance the cross-border yuan payment system, optimize the global layout of yuan clearing banks, strengthen monetary cooperation with foreign monetary authorities, and steadily promote the healthy development of the offshore yuan market.

CIPS is a wholesale payment system dedicated to handling cross-border yuan payment and settlement service which is approved by the PBC. It aims to provide safe, efficient, convenient, and low-cost fund clearing and settlement service, serving as a crucial financial market infrastructure in China.

As of now, CIPS has a total of 153 direct participants and 1,413 indirect participants, among which 1,052 are from Asia, 241 from Europe, and 53 from Africa.

The Chinese yuan has become the fourth most active currency in global payments, the second largest currency in global trade financing, and the third largest currency in the Special Drawing Rights currency basket, Lu noted.

During Sibos 2024, Standard Chartered Bank and Bank of Communications signed a digital currency strategic cooperation memorandum to promote joint innovation and business development in the field of digital currencies, including the digital yuan.

According to the memorandum, the two parties will establish a joint working group to explore establishing a basic system and mechanism for cross-border payment and settlement of digital currencies, enhance the efficiency and convenience of cross-border payment and settlement and create a richer array of digital currency application scenarios, thus promoting the expansion of the application scope of digital currencies.

In the afternoon's trading, stocks of cross-border payment surged, with CNPC Capital, North King and NEXGO hitting the daily limit. Eclicktech, Infosec, Global InfoTech and several other stocks rose more than 7 percent.

Global Times