China remains world's largest steel market, with annual consumption exceeding 800 million tons: industry association

A press conference is held by China Iron and Steel Association on October 25, 2024. Photo: Yin Yeping/GT

China remains the world's largest steel market, with annual consumption exceeding 800 million tons, and the manufacturing sector is emerging as a key driver for industry growth as the industry undergoes structural improvements, China Iron and Steel Association (CISA) said at a press conference on Friday.

At the same time, the domestic steel industry faces numerous challenges, including supply-demand imbalances, a rise in international trade protectionism, and high raw material costs, according to the CISA.

In the first three quarters, apparent consumption of crude steel decreased by 6.2 percent year-on-year.

In August, apparent consumption of crude steel fell by 13.5 percent, and in September it dropped by 11.1 percent, marking two consecutive months of double-digit declines and highlighting the increasing pressure on the dynamic balance of supply and demand, according to the CISA.

However, steel exports have increased year-on-year, highlighting the strong demand for Chinese steel products in the international market. According to customs data, China exported a total of 80.71 million tons of steel in the first three quarters, a year-on-year increase of 21.2 percent.

During the same period, the average export price of steel was $770 per ton, a decrease of 21.6 percent year-on-year, indicating that high raw material costs are further squeezing profit margins for steel companies.

According to the CISA, while steel prices are declining, iron ore prices remain elevated. Monitoring by the CISA shows that the average value of the China Steel Price Index (CSPI) in the first three quarters was 103.66 points, down 7.67 percent year-on-year. In the first week of September, the CSPI fell to 90.42 points, the lowest level in nearly seven years.

High raw material costs are leading to further compression of profit margins for steel companies.

In the first half of this year, the sales profit margin for key surveyed steel enterprises was only 1.1 percent, while the sales profit margins for the four major international mining companies ranged from 25.5 to 45.0 percent, indicating a severe imbalance in the distribution of benefits along the industrial chain, according to the CISA.

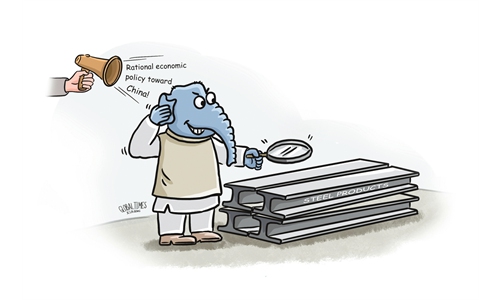

Meanwhile, the rising protectionism has posed challenges to the steel industry. According to the industry association, the anti-dumping and countervailing investigations targeting China's steel-related products have been on the rise, with the case number reaching 23 so far this year, said the CISA. The association said that the figure could exceed 25 for the entire year, surpassing the total from the previous three years.

There are clear signs of rising international trade protectionism against Chinese steel products, with various forms of trade barriers escalating quickly, Jiang Wei, vice president of the association, said on Friday, noting that as a result, the risks and challenges to steel exports are growing.

Despite the challenges, the development of China's steel industry continues to show resilience as the industry undergoes a structural optimization.

Since the beginning of this year, the characteristics of the steel industry have increasingly indicated a phase of slower growth and optimization of existing capacity, Jiang said.

Specifically, the accelerated development of sectors such as new energy, high-end equipment manufacturing, and the photovoltaic industry will significantly boost the demand for specialized types of steel.

The focus of steel demand is gradually shifting toward the manufacturing sector, with manufacturing accounting for 48 percent of total demand and construction industries making up 52 percent in 2023.

At the same time, the real estate industry has entered a phase of structural optimization. Demand for construction steel is declining but is anticipated to see slight improvements, said the CISA.

Around this year's National Day holidays, the government introduced a package of policies aimed at financially supporting high-quality economic development and promoting economic stabilization, which has boosted market expectations for steel, said the CISA.

Additionally, the ongoing major equipment upgrades and the promotion of trade-in policies across multiple sectors are expected to create a favorable external environment for the development of the steel industry, according to the CISA.

Shi Hongwei, deputy secretary of the CISA, said on Friday that the steel consumption in China in 2025 is expected to be roughly in line with this year's levels, with the proportion of steel used by the manufacturing sector rising and becoming an increasingly important support factor of the market.

Meanwhile, the industry association said that it will quickly establish a mechanism for phasing out existing capacity, creating conditions to guide the exit of outdated capacity and promote steel production toward advantageous capacity.

By the end of 2025, the goal is for key regional steel enterprises to complete ultra-low emission transformations, with a national target of over 80 percent of production capacity undergoing upgrades, said the CISA.