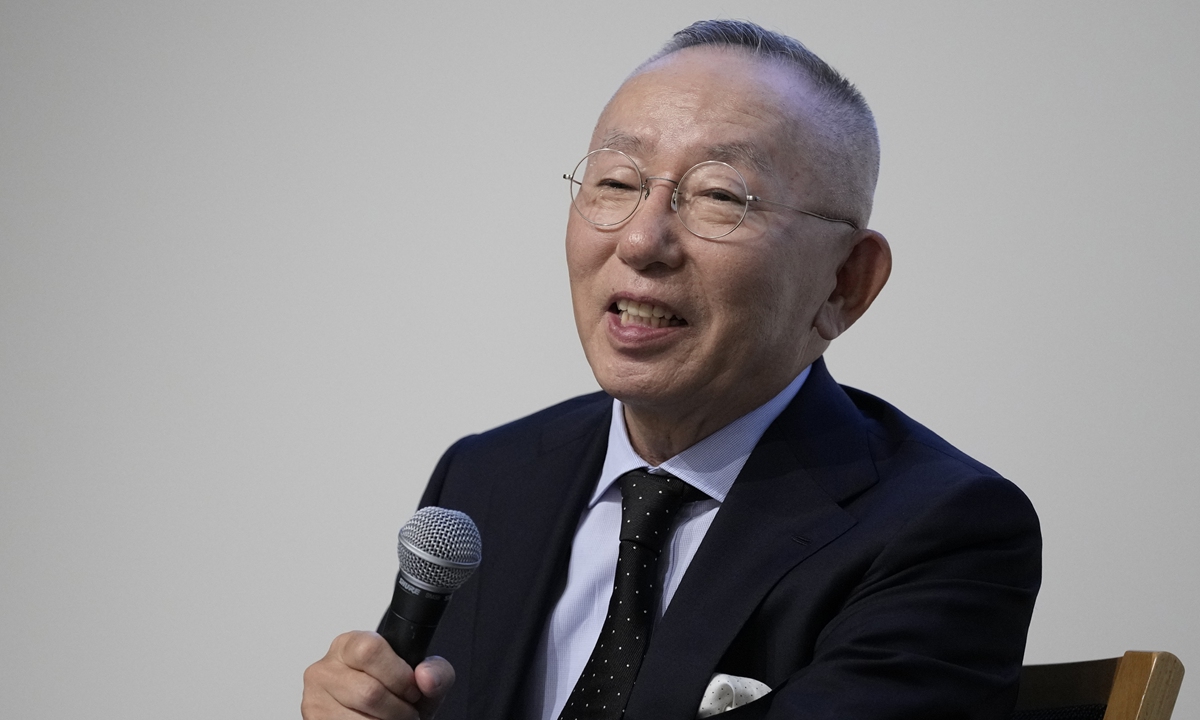

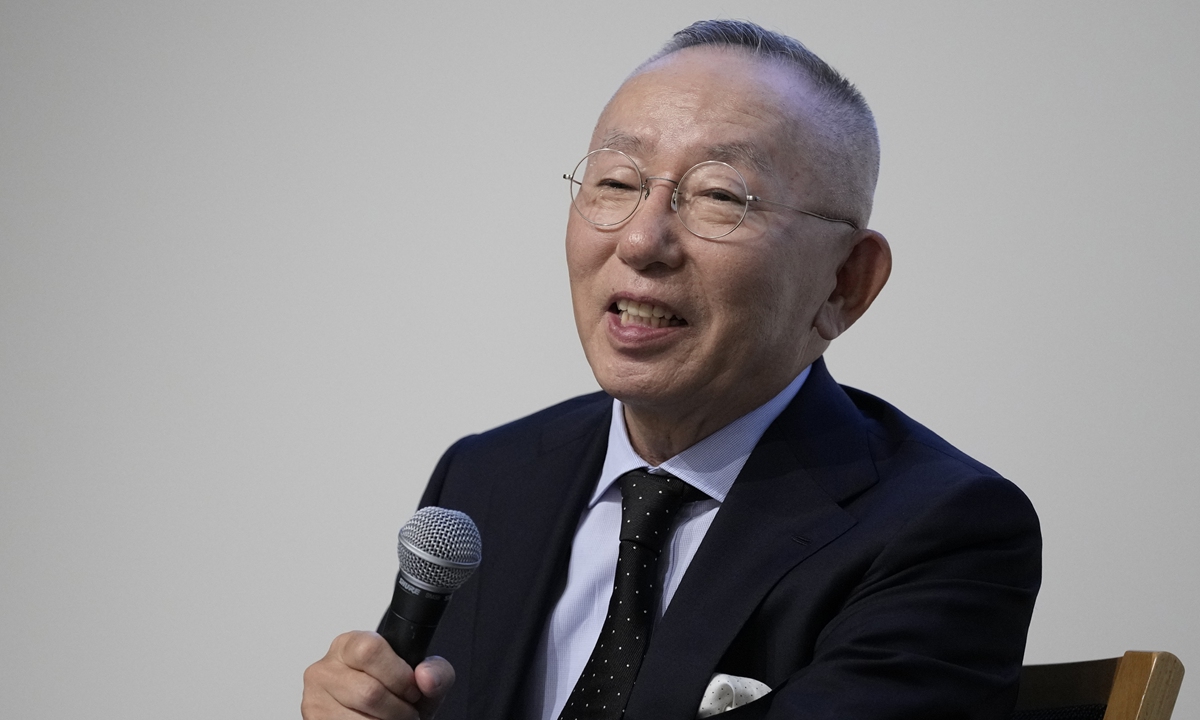

Tadashi Yanai, chairman and chief executive officer of Fast Retailing Co, speaks during a news conference in Tokyo, Japan, on Thursday, Oct. 10, 2024. Photo: VCG

Fast Retailing Co, the Japanese company behind global clothing retailer Uniqlo, will continue to invest in China and "China's importance has not changed," said Chairman and CEO Tadashi Yanai in an interview with Nikkei, emphasizing China's irreplaceable role in the company's supply chain.

Moving production out of China would be unfeasible. It's not easy to build large-scale factories quickly, as there is a history of attempts that has failed and it is impossible to easily replicate the model of Chinese factories, he said.

Our growth had paralleled China's development, Yanai said, underscoring Fast Retailing's alignment with China's industry and economic development.

He emphasized the company's priority on business development, while drawing a clear distinction from calls for "decoupling."

China's textile and apparel sectors are essential thanks to their broad industrial advantages, Wang Zhuo, a professor at Jiangxi Institute of Fashion Technology, told the Global Times on Sunday. China has the world's largest apparel production capacity and an end-to-end industrial chain, encompassing design through to logistics, Wang added.

According to Wang, Chinese clothing brands benefit from efficient logistics and easy access to a wide range of materials, enabling a rapid production of new designs.

"From buttons to down feathers, brands can find any component they need and swiftly begin production," he explained.

China's apparel industry's agility encompasses both materials and production methods. As labor costs rise, China's apparel sector is increasingly adopting digital and intelligent manufacturing to keep pace. This small-scale, responsive production model reduces inventory risk and enables brands to quickly react to market trends, Wang noted.

Data further highlights China's stronghold in the sector. According to the General Administration of Customs, China's textile exports, including yarn and fabrics, grew steadily to reach 80.18 billion yuan ($11.26 billion) in September and totaled 741.71 billion yuan in the first nine months, marking a 4.8 percent increase year-on-year.

Moreover, many foreign firms remain optimistic about China's market, with a recent survey by the China Council for the Promotion of International Trade finding that 90 percent of surveyed foreign companies rated China's business environment as satisfactory or better in the third quarter. Nearly 50 percent highlighted China's growing market appeal, and nearly 20 percent plan to increase investments in the country.

Fast Retailing has seen a substantial growth in the Chinese market, a recent annual report for the year ending August 31, 2024, noted a 9.2 percent year-on-year of the firm's revenue growth in the Greater China region to 677 billion yen ($4.4 billion), with operating profits reaching 104.8 billion yen.

By October, Uniqlo had reached 925 stores in the Chinese mainland. The company plans to further expand, with a goal of reaching 1,000 stores, according to Shanghai Securities News, highlighting its continued confidence in China's market potential.

Fast Retailing previously faced scrutiny over its stance on sourcing Xinjiang cotton. In an August 17, 2020 statement on its website, the company said, "No Uniqlo product is manufactured in the Xinjiang region. In addition, no Uniqlo production partners subcontract to fabric mills or spinning mills in the region." On January 5, 2021, US Customs and Border Protection detained a shipment of Uniqlo cotton garments, citing a violation related to the Xinjiang Production and Construction Corps.

In 2022, Yanai chose not to confirm Uniqlo's cotton sourcing from Xinjiang, stating that he aimed to maintain neutrality between China and the US. He said that the US approach seemed to compel companies to declare their loyalties, asserting that "Uniqlo won't play that game," the Xinhua News Agency reported.

Using Xinjiang-related issues as an excuse to force multinational companies to pick a side between China and the US is out-and-out political coercion, Chinese Foreign Ministry spokesperson previously said, noting it will not only damage the interests and national credibility of the US but also undermine the stability of supply chains and disrupt the international trade order.