Well-known brands flock to CIIE, displaying confidence in China

Luxurious consumption

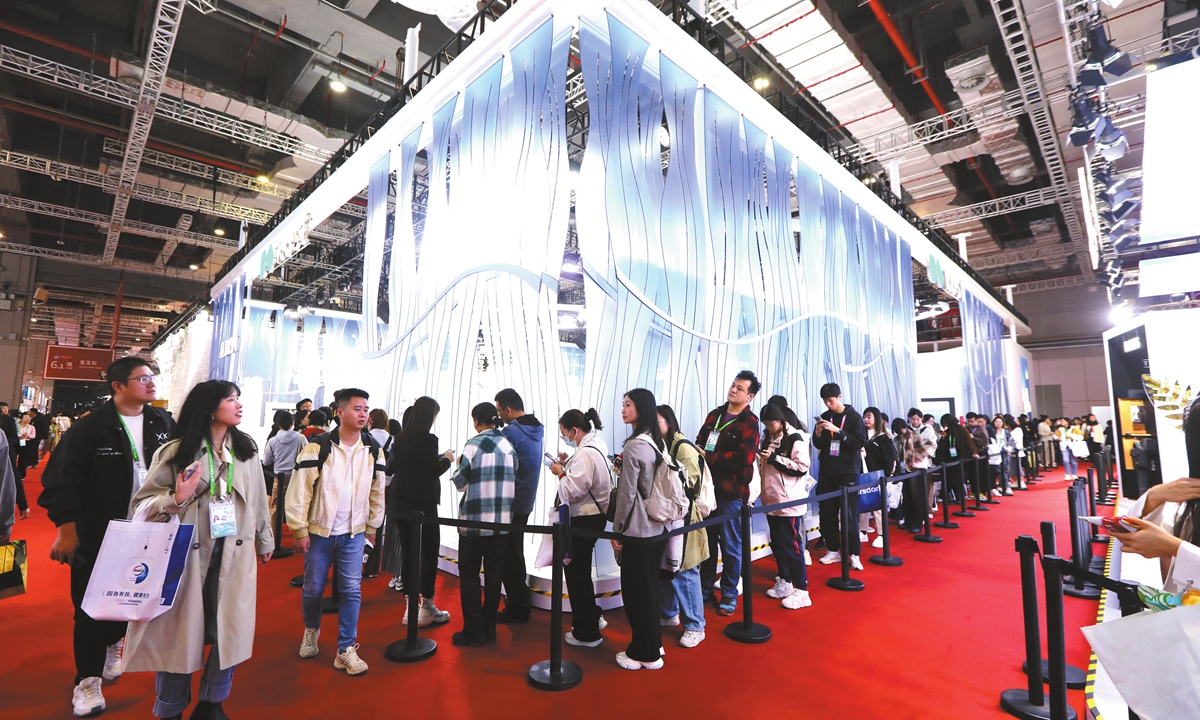

Visitors line up to explore consumer goods exhibition booths at the 7th CIIE in Shanghai on November 7, 2024. Photo: Chen Xia/GT

Luxury international brands are focusing on exploring China's massive market by appealing to younger consumers at this year's China International Import Expo (CIIE). Many are showcasing products that blend Chinese cultural elements with artistic design chic as they continue to expand and invest in China.

For instance, Vacheron Constantin's booth at CIIE displayed two wristwatches featuring a traditional Chinese pattern of ocean waves and cliffs blending Eastern aesthetics with watchmaking craftsmanship.

Similarly, Brioni, a brand under the Kering Group, introduced new designs and collections that feature vibrant colors and modern styles appealing to the aesthetic of younger consumers.

"In recent years, the brand has launched some casual series targeting young Chinese consumers. Recent color launches such as lemon green, mint green, and burnt brown are specifically designed for this demographic," an employee at the booth told the Global Times.

The Chinese market is rapidly growing in its overall brand landscape, with a swift expansion of outlets, the Global Times learned from the brand.

Talent development

At the accessible luxury booth of Coach, the Global Times observed that the brand collaborated with Donghua University, inviting young university students to participate in the design of leather bags.

At present, Coach has cooperated with several universities to launch youth talent development programs, jointly creating a platform for cultivating new talent in China's fashion innovation, according to the company.

"This year is our sixth consecutive year of participation in CIIE. Over the past six years, we have witnessed the continuous expansion of CIIE's scope and increasing influence, and deeply felt China's firm determination to promote high-standard opening-up and high-quality development," Yann Bozec, president of Tapestry Asia Pacific and CEO of Coach Asia Pacific, told the Global Times in a written statement.

"We look forward to leveraging the open platform of the CIIE to explore new opportunities and to bring a better lifestyle to more Chinese consumers," Bozec said.

This year also marks the debut of luxury athleisure brand Lululemon at the CIIE.

André Maestrini, executive vice president, International, Lululemon, told the Global Times in a statement that the Chinese market has quickly become a key growth engine for Lululemon's global business. And by 2026, the company expects the Chinese mainland to become its second-largest market worldwide, with over 200 stores.

"This moment is the kick-off of the next ten-years of growth and innovation in China. We are committed to keep investing in China to unlock its growth potential," Maestrini said.

Germany based consumer goods company Beiersdorf AG unveiled two of its premium brands to the Chinese market for the first time at CIIE.

"We highly value our participation in this year's CIIE, as it serves as an important opportunity to deepen our collaboration with the Chinese market and share development prospects. China is one of the key strategic markets for Beiersdorf, and we recognize the immense vitality and growth potential it offers," Shirley Xue, managing director of North East Asia, Beiersdorf, told the Global Times.

Growing consumption

It is important to note that China has become a key market in global luxurious consumption.

According to a report by Tencent Marketing Insights (TMI) and Boston Consulting Group (BCG), luxury goods consumption in China is expected to reach 572 billion yuan ($79.82 billion) in 2024, representing a 4-percent increase from the previous year.

China has consistently contributed 20 percent to 25 percent to the global luxury goods market over the past five years, according to the report.

In particular, consumers under 30 account for nearly half of the market, which increased by 2 percent from a year ago. These emerging groups are crucial for the future growth opportunities of luxury brands, according to the research report.

In this context, luxury brands are accelerating their expansion and investment layout in China.

For example, Eric du Halgouet, executive vice president of finance for Hermes, said at an earnings call in October that the group will continue to invest in the Chinese market with plans for a new flagship store in Beijing next year, Reuters reported earlier.

China's luxury goods market is growing steadily, driven by rising purchasing power and an expanding base of potential buyers in China, making it an attractive market for international luxury brands, Zhang Yi, CEO of the iiMedia Research Institute, told the Global Times on Thursday.

Younger consumers are increasingly important for luxury brands, as they value individuality and unique experiences. This shift offers luxury brands a good opportunity to engage the specific demographic and cater to their preferences, Zhang said.

"Also, for the Chinese market, the growth of online channels has been significant," Zhang said.

Redoubling its efforts to expand its marketing share in China, LVMH group in May deepened its partnership with Alibaba to leverage the e-commerce firm's cloud and artificial intelligence capacities to further enhance the high-end retail experience for Chinese consumers, the French luxurious group said.

Around 30 brands under the LVMH group have cooperated with Tmall.com, leveraging Alibaba's digital capabilities to offer consumers an interactive online shopping experience that includes features such as 3D product displays and virtual try-ons, the LVMH group said.

China is expected to become the world's largest luxury market by 2025, according to the global management consulting firm Bain & Company.