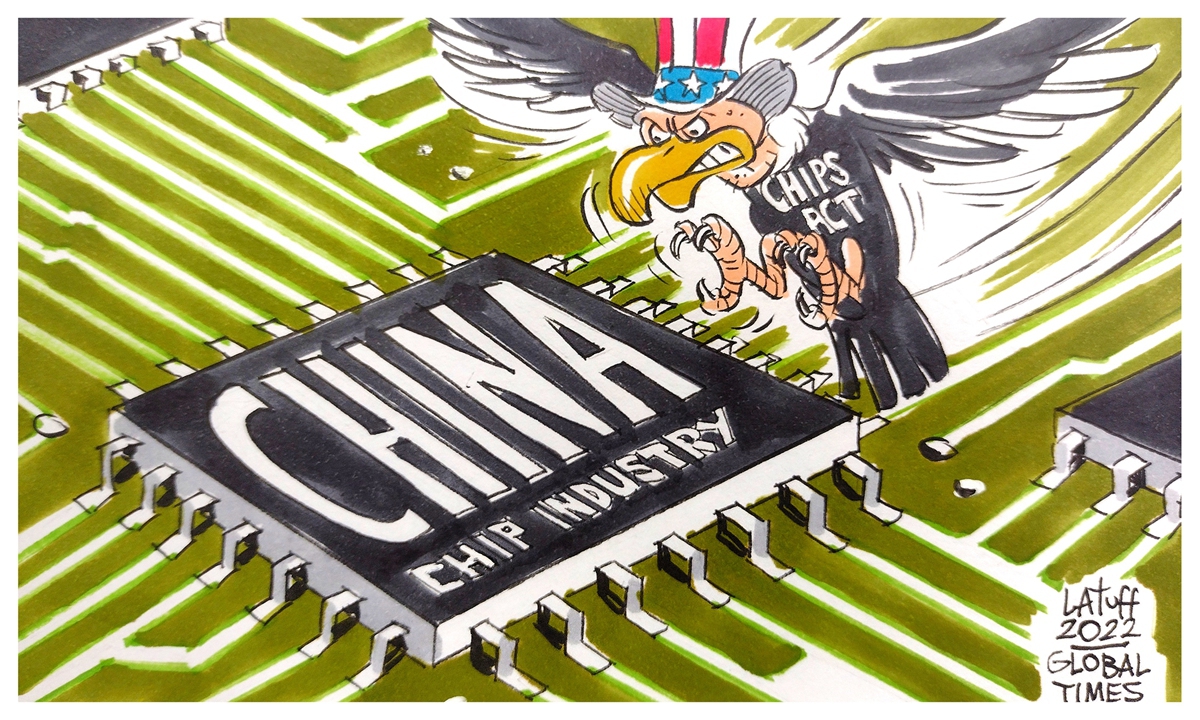

US claws at China's chip industry fanning flames on tech confrontation. Cartoon: Carlos Latuff

Despite the challenges posed by the US-led technological blockade and various forms of international pressure, confidence in China's semiconductor industry has markedly strengthened, driven by encouraging developments and substantial policy support.The CSI Semiconductor Index surged to a gain of 6.84 percent on Monday, touching the highest level since December 2021, while the CSI Integrated Circuits Index's gain stood at one point at 5.44 percent on Monday.

The significant gains on Monday came right after the news over the weekend that the US Department of Commerce had sent a letter to TSMC imposing export restrictions on certain sophisticated chips - of 7-nanometer or more advanced designs - destined for Chinese mainland customers, the South China Morning Post reported.

Surprisingly, the market's initial reaction far exceeded many analysts' expectations. Rather than exhibiting panic, investors responded with optimism, believing that this external pressure would serve as a catalyst for accelerating self-reliance and fostering independent innovation among Chinese mainland companies in the semiconductor sector.

This positive market response reflects an affirmation of the progress made by China's semiconductor industry and also underscores the high expectations surrounding its potential for development across various dimensions, including but not limited to technological innovation as well as the optimization and upgrading of the industrial supply chain.

In recent years, the US has continuously stepped up export controls on advanced technology and relevant products to China, presenting significant challenges for the Chinese semiconductor industry.

However, it is precisely in facing such adversity that Chinese semiconductor companies have demonstrated remarkable resilience and self-development capabilities. In the face of external pressures, the self-sufficiency rate of China's semiconductor industry has been steadily increasing.

If anything, this trend indicates that China's position in the global semiconductor industry is gradually improving and reflects the acceleration of China's independent innovation and localization processes in the semiconductor field.

As the global semiconductor market is projected to exceed $1 trillion by 2030, the growth potential in the Chinese market is significant and cannot be ignored, offering substantial opportunities for independent innovation in China's semiconductor industry.

While ramping up research and development (R&D) efforts and promoting domestic production, China's semiconductor industry is also accelerating its procurement of semiconductor equipment. According to the latest data from SEMI, China's spending on chip manufacturing equipment reached a record-breaking $25 billion in the first half of 2024, surpassing that of countries such as the US and South Korea.

Amid a global economic slowdown, China is the only country where spending on chip manufacturing equipment continued to increase year-on-year in the first half of this year. The figures underscore the determination of the Chinese semiconductor industry to enhance its production capacity and technology.

While Chinese semiconductor companies have made notable strides in the low- to mid-end market, it is essential to acknowledge that significant challenges remain for breakthroughs in semiconductor technology. The heightened US export controls, although strengthening China's resolve to carry out independent innovation in the short term, present a substantial long-term challenge for the Chinese semiconductor industry - that is, achieving advancements in high-end technology.

For example, there remains a significant gap between China's technological capabilities and the world's most advanced lithography equipment. If breakthroughs in core semiconductor technologies, such as domestically produced lithography machines, do not materialize as anticipated, it could negatively affect the capacity expansion and production plans of domestic chip manufacturers.

The journey for Chinese semiconductor companies in the high-end sector remains long and arduous. On the one hand, there is a need to continue increasing R&D investment, focusing on breakthroughs in core technologies and enhancing self-controllable capabilities. This requires not only the efforts of the companies themselves but also support from the government, universities and research institutions. On the other hand, it is also necessary to strengthen international cooperation, participating in the development of the global semiconductor industry chain.