China to roll out pragmatic measures attracting foreign investment: CSRC

HKSAR vital for bridging mainland with global markets

A general view of the Victoria Harbor in the Hong Kong Special Administrative Region, on February 13 Photo: VCG

China's top securities regulator said on Monday that the authority is launching a new round of reform and opening-up of the capital market, as more measures will be rolled out to create a better environment for global investors to participate in the Chinese market.

The China Securities Regulatory Commission (CSRC) will introduce more pragmatic measures involving market access and cross-border investment and financing facilitation, Wu Qing, chairman of the CSRC, said at the HKEX Connect Summit via video, domestic news site stcn.com reported.

The summit was held in celebration of the 10th anniversary of the Stock Connect between the capital markets of the Chinese mainland and the Hong Kong Special Administrative Region, following the initial launch of the Shanghai-Hong Kong Stock Connect on November 17, 2014.

Highlighting the CSRC's efforts to create a better environment for international investors, Wu noted that it sticks to the direction of marketization, the rule of law and internationalization.

Wu said that the CSRC will work closely with the Hong Kong regulators to promote the mutually beneficial and win-win development of the capital markets of the two sides.

Li Ming, a vice chairman of the CSRC, said at the summit that the commission will promote the comprehensive institutional opening-up of markets, institutions and products.

From the market perspective, Li outlined measures including further improving the connectivity programs, broadening overseas listing channels for mainland-based enterprises and expanding the futures market's opening-up.

The CSRC will support more foreign institutions to invest and expand in China as well as back up more qualified mainland institutions to conduct cross-border businesses, according to Li.

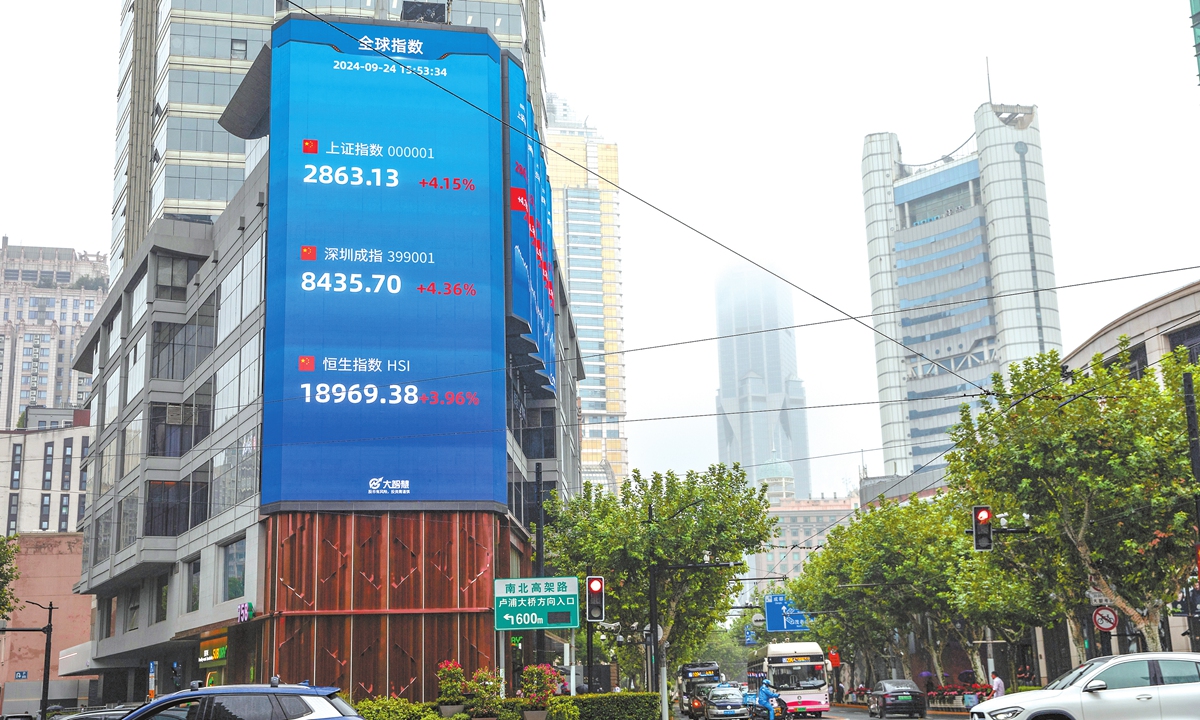

An outdoor billboard in Shanghai shows real time data on September 24, 2024 afternoon that the Shanghai Composite Index rebounded by 4.15 percent to 2,863.13 points, with the Shenzhen Component Index soaring 4.36 percent, and the Hong Kong Hang Seng Index soaring 3.96 percent to 18969.38 points. The closing data on the day was even higher. Photo: VCG

As for product development, Li detailed means such as supporting the launch of more cross-border exchange-traded fund products and optimizing mutual recognition of funds between the mainland and the HKSAR.

China has realized notable achievements in boosting the high-quality opening-up of the capital market in recent years, represented by the establishment of more convenient investment channels, the continuous lowering of thresholds for foreign investors, and the growing scale of listed mainland firms overseas, said Wang Peng, an associate research fellow at the Beijing Academy of Social Sciences.

Wang told the Global Times on Monday that the achievements have elevated the international competitiveness of the country's capital market while injecting vitality into China's economic development.

Chinese authorities have been ramping up efforts to attract foreign investment. Earlier this month, the Ministry of Commerce and five other departments released revised regulations for foreign investment in listed companies, making it much easier for overseas investors to invest in Chinese listed firms.

The thriving development of connectivity programs over the past decade is a vivid example of Hong Kong's vitality as a financial hub linking the Chinese mainland with international investors.

More than 70 percent of international investors put money into the Chinese mainland through the Shanghai-Hong Kong and Shenzhen-Hong Kong stock connects, Hong Kong's Chief Secretary for Administration Eric Chan Kwok-ki said at the summit. Chan is the acting chief executive while John Lee Ka-chiu is in Peru attending an APEC meeting.

Wang said that Hong Kong's mature financial market, sound legal environment and rich experience in international finance have become important links bridging mainland enterprises with global markets.

He noted that the flourishing development of the Guangdong-Hong Kong-Macao Greater Bay Area (GBA) enhances the competitiveness of both the Chinese mainland and the HKSAR, creating more favorable conditions for China to draw in foreign investment.