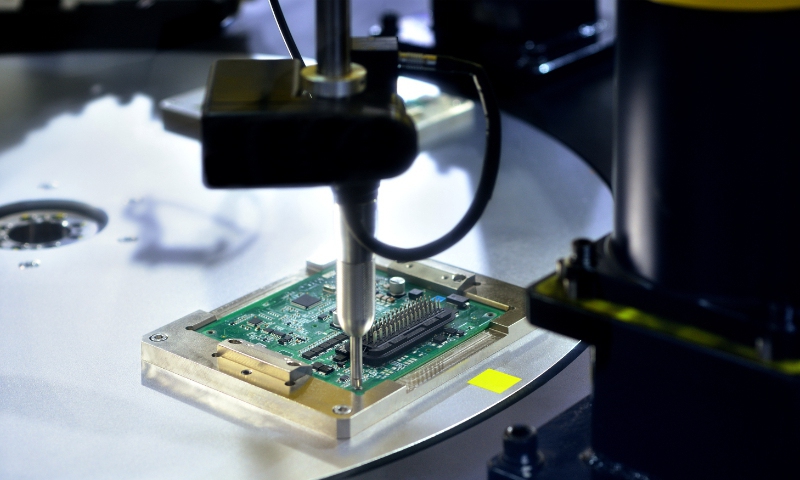

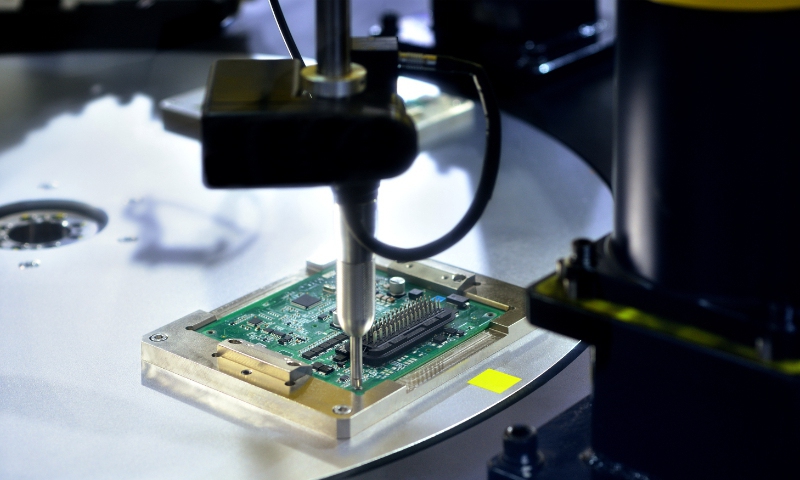

Production of semiconductor chip File photo: VCG

European computer chipmaker STMicroelectronics said on Wednesday that it is working with Hua Hong Semiconductor, China's second-largest bespoke chip maker, to manufacture microcontroller chips at the 40-nanometer node in Shenzhen, South China's Guangdong Province by the end of 2025, Reuters reported.

The move is a signal that more global enterprises are ramping up cooperation in the Chinese market for its enormous business potential and stable supply chain, a Chinese observer said.

When reached out to by the Global Times via phone on Thursday, a staff member from Hua Hong confirmed that the two companies have relevant cooperation, adding that no more information is available at the moment.

Jean-Marc Chery, CEO of STMicroelectronics, said on Wednesday that having local manufacturing in China is vital to its competitive position, Reuters reported. The company is the biggest maker of energy-efficient Silicon Carbide chips used in electric vehicles (EVs) - with customers including Tesla and Geely.

Chery reportedly said that the Chinese market proper is indispensable as the largest and most innovative for EVs, and it is not possible to compete adequately from outside.

He noted that the company is adopting best practices and techniques it learned in the Chinese market for use in Western markets. "The missionary story is over," Chery said.

STMicroelectronics' head of manufacturing Fabio Gualandris said the reasons to produce in China include the cost benefits of local supply chains. In addition, making chips anywhere else would mean missing out on China's rapid EV development cycle, according to the Reuters report.

The cooperation and Chery's remarks reflect China's maturity and stability of its supply chain in global semiconductor manufacturing, Wang Peng, an associate research fellow at the Beijing Academy of Social Sciences, told the Global Times on Thursday.

Wang noted that China's complete supply chain can provide rich resources and support for semiconductor manufacturers. He stressed that the country's vast market demand will offer broad development space for industry players and will drive continued innovation and growth for the sector.

Wang also highlighted the country's innovative advancements and firm policy support as other major advantages that contribute to the industry's international cooperation.

This cooperation is just the latest demonstration that foreign enterprises are bullish on expanding deployment and collaboration in the Chinese market.

The seventh China International Import Expo, which concluded in early November in Shanghai, saw a total of $80.01 billion worth of tentative deals reached for one-year purchases of goods and services, an increase of 2 percent from that of last year.

On November 1, China removed all market access restrictions for foreign investors in the manufacturing sector, a landmark move by the world's second-largest economy as it opens its doors wider.

With the continuous development of China's economy and its increasing opening-up, more global enterprises are eyeing the great potential and stability of the Chinese market while recognizing the advantages of Chinese enterprises in technological innovation, product quality and service level, Wang said.