Industry watch at Wuzhen Summit: Chinese AI companies are riding the wave of global expansion

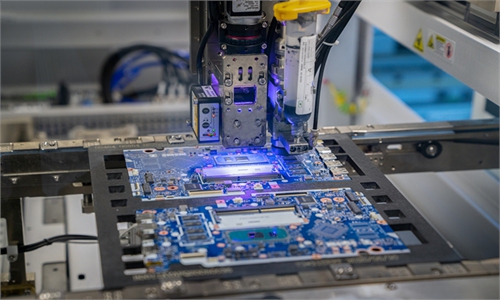

AI Photo: VCG

China's artificial intelligence (AI) industry is currently experiencing rapid growth, with both established tech companies and unicorn startups starting to explore international markets.

Leading tech giants including ByteDance, Baidu and Tencent and emerging unicorns such as Shanghai-based MiniMax, Beijing-based Moonshot AI and 01.AI are seizing new opportunities in the global market, seeking to leverage their peculiar strength in AI innovations.

At the 2024 World Internet Conference (WIC) Wuzhen Summit, held from November 19 to November 22 in Wuzhen, East China's Zhejiang Province, industry analysts said that Chinese companies specializing in large language models (LLMs) are now ramping up their research and development efforts on self-managed platforms, while accelerating the application of AI technology in other industrial sectors.

At the same time, these tech giants are recalibrating their growth strategies, by exploring overseas market in order to rake in more business revenues.

The move comes as Chinese LLM ventures face increasingly fierce competition from global rivals, as the prices for purchasing LLM services continue to drop in the market.

A June report from the Shenzhen-based Unique Research showed that, out of 1,500 very active AI companies worldwide, 751 are based in China, with 103 already expanding internationally, underscoring the growing footprint of Chinese AI firms.

According to a report by the research firm Sensor Tower, three Chinese AI apps were listed among the top 10 most-downloaded AI apps in the US from January to June this year.

The current wave of Chinese AI ventures going global is a testament to the growing competitiveness of Chinese AI companies, while also speaks of the country's technological innovation capability.

"AI is expected to generate numerous opportunities. Chinese AI firms can leverage their technological expertise and product innovation to seize a larger share of the global market," Zhou Hongyi, the founder and chairman of 360 Security Technology, told the Global Times.

Leading players

Major players like Huawei, Alibaba and iFlytek have recently launched their AI products overseas, ushering in a new phase of global AI cooperation. In May, Huawei launched its Galaxy AI as part of efforts to support its digital transformation initiative in North Africa.

Alibaba launched SeaLLMs in 2023 in the Southeast Asian market to cater to growing demand there, aligned with the firm's e-commerce and cloud computing business in the region.

ByteDance introduced consumer-oriented AI applications, including the "AI homework helper" Gauth, the interactive character app AnyDoor, and the AI bot platform Coze for global markets. Minimax, one of China's leading AI start-ups, also launched Talkie AI for international users.

Notably, the tech giants have focused their global strategies in exploring markets in Southeast Asia and the Middle East. Additionally, the demand for AI technology is rising in markets across Latin America and African countries along the Belt and Road Initiative.

Shen Yang, a professor studying AI and media at Tsinghua University, said that Africa, Middle East and Southeast Asia have lower entry barriers compared to Western markets, which will enable Chinese AI tech companies to earn more in international market competition.

According to Shen, these AI giants are expanding their global presence by establishing research and development centers overseas, forming strategic partnerships, and participating in the development of international standards. The efforts underscore their dedication to innovation and cooperation, establishing them as key players in the rapidly evolving AI landscape.

For example, an AI app Talkie developed by MiniMax has achieved notable success in overseas markets and become profitable.

According to the information the company shared with the Global Times, Talkie has achieved a milestone of 11 million monthly active users, half of them coming from the US. The app, launched 17 months ago, has established a significant user base in the US, the UK, and other countries. To date, it has been downloaded nearly 14 million times, generating total revenue of about $830,000.

"A deep commitment to AI technological advancement is the prerequisite.Only by achieving significant technological progress and establishing a robust business model can a company achieve sustainable growth," said Yan Junjie, founder of Shanghai-based AI unicorn MiniMax.

Heated competition

Sheng Jingyuan, general manager of MiniMax's overseas business section, who once worked in Silicon Valley, told the Global Times that "Chinese companies have adopted distinct approaches in AI development, and they could potentially outpace their Western counterparts in AI applications."

During the recent years, China has achieved marked progress in AI research and development, and particularly in AI application, consistently establishing itself as a pioneer in the global AI industry.

China and the US now lead the global AI sector, according to the World Internet Development Report 2024 released by the Chinese Academy of Cyberspace Studies at the Wuzhen Summit on Thursday.

US companies are generally good at developing advanced large AI models, whereas their Chinese counterparts prioritize developing strengths in AI innovation and market applications, the report said.

"As the global competition in AI intensifies, Chinese AI companies are accelerating their independent innovation capability and we are already seeing many positive outcomes," Wang Shijin, executive dean of the iFlytek AI Research Institute, told the Global Times.

As Chinese AI companies expand their footprint abroad, the world will likely experience a fresh wave of AI innovations, with Chinese companies likely to play a pivotal role, driven by their advancements, Wang said.

This is echoed by Zhou Hongyi. "Aided with the collective efforts of the entire industry and the government support, China's LLM industry has established itself as a global leader," Zhou said.

According to official data, by July 2024, the number of AI models registered at the Cyberspace Administration of China had exceeded 197, covering finance, healthcare, education and more sectors.

However, China also faces considerable challenges. The US has imposed strict restrictions over exports of high-end AI chips and chip-making equipment to China. It has intensified scrutiny of Chinese investment in AI.

"China's LLM startups ought to constantly build up their strength and strengthen innovation in order to address the limitation in computing power, and chip supply," Zhou noted.