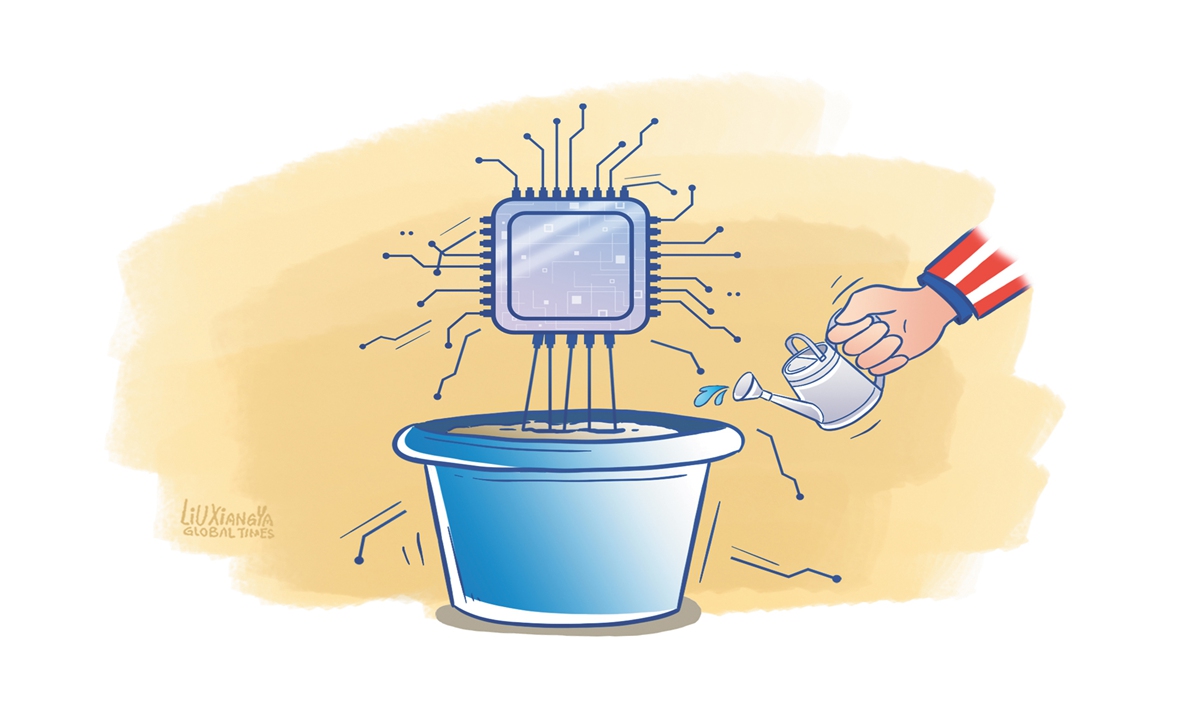

Illustration: Liu Xiangya/GT

The US Commerce Department announced Tuesday that it is finalizing a $7.86 billion government subsidy for Intel, down from the proposed $8.5 billion in March after the California-based chips maker won a separate $3 billion award from the Pentagon, Reuters reported. While the funding is significant, it remains unclear whether it will be sufficient to help Intel overcome its challenges.The award will support nearly $90 billion in manufacturing projects across the US states of Arizona, New Mexico, Ohio, and Oregon. However, Intel's business performance continues to fall short of expectations. This raises a more fundamental question: Will these subsidies be enough to give Intel a sustainable competitive edge?

Intel reported the largest quarterly loss in its 56-year history last month. The chipmaker said its third-quarter losses totaled $16.6 billion, according to the New York Times. Earlier this year, it announced plans to cut 15,000 jobs.

As is well known, in recent years, the global manufacturing supply chain has been undergoing significant adjustments, largely due to changes in international trade, as well as the push for technology "decoupling" promoted by US policymakers. Although Intel will receive substantial subsidies, this funding - reportedly to be disbursed based on "specific milestones" - may not provide a quick boost to the company in the short term. Moreover, focusing on domestic investment plans in the US could disrupt Intel's global manufacturing network, potentially increasing overall production costs.

It is undeniable that the US leads in certain chip technologies and related industries. However, domestic chip manufacturing remains a weak point. Several deeply rooted factors hinder the growth of US manufacturing, such as a shortage of skilled workers and the absence of a fully developed industrial supply chain. Subsidies alone cannot address these fundamental issues, and their effectiveness in boosting US chip production is limited. Moreover, most subsidies are concentrated on a few large companies, with inadequate support for small and medium-sized chip firms, as well as the upstream and downstream sectors of the supply chain. As a result, establishing an efficient semiconductor manufacturing industry ecosystem in the US remains a significant challenge.

Of course, this doesn't mean that the $7.86 billion subsidy lacks practical significance. At the very least, it could help fund the construction of several semiconductor factories in the US. If these factories are completed and begin operations, they are likely to be highlighted by the media as symbols of the so-called resurgence of semiconductor manufacturing in the country, sparking new discussions about global competition in the chip industry. Some analysts argue that the US subsidy will encourage increased investment both in the US and abroad, attracting investors from various regions to the semiconductor sector. This, in turn, is expected to intensify competition within the industry.

Amid the ongoing industrial transformation fueled by emerging technologies like big data and artificial intelligence (AI), semiconductors have become the bedrock of innovation, research, and production in high-tech industries. As the global chip market becomes increasingly competitive, this trend seems all but inevitable. While some suggest that subsidies may no longer be a central strategy for the US in the coming years, it's widely believed that efforts to revitalize its domestic chip industry by curbing the growth of others' chip sectors are unlikely to cease - and may, in fact, intensify.

Faced with escalating international competition, external pressures, and increasing uncertainty, China must redouble its efforts to encourage independent innovation. This can be achieved through strategic measures such as boosting R&D investments, refining industrial policies, and attracting top-tier talent.

In recent years, China's domestic semiconductor sector has made impressive strides in technological innovation. Numerous chip companies have increased their R&D spending and launched a range of products with proprietary intellectual property. As an important player in the global semiconductor market, China's expanding industry also opens up fresh opportunities for international manufacturers.

The author is a reporter with the Global Times. bizopinion@globaltimes.com.cn