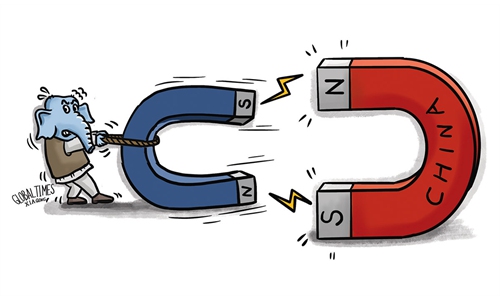

Illustration: Liu Xiangya/Global Times

Global investors are treasure-hunting in China's undervalued capital markets. On Monday, Wall Street traders spent approximately $55 million to buy call options on a leveraged ETF tracking the benchmark CSI 300 Index, which tracks the top 300 shares on the Shanghai and Shenzhen stock exchanges, the Shanghai Securities News reported on Tuesday. Typically, the trading volume of long options on the CSI 300 Index on Wall Street is significantly lower than this figure.A number of foreign financial institutions have recently raised the target share prices for Chinese mainland companies listed in the Hong Kong Special Administrative Region. For instance, JPMorgan increased the target price for service-focused e-commerce giant Meituan.com from HK$140 ($17.99) to HK$200 ($25.69), according to the Shanghai Securities News.

The development underscores the recognition and strong confidence among global investors of China's economic growth potential. Despite external voices expressing concerns over the US push for financial "decoupling" from China, the fundamentals of the Chinese economy are solid, providing a strong foundation for its capital market to attract foreign investment. The Chinese economy continues to maintain a steady growth rate of around 5 percent, which is both impressive and rare in the global economic landscape. Consequently, amid global economic uncertainty, the unique appeal of Chinese assets has been growing, making them an ideal choice for many investors seeking a balance of safety and growth.

It is worth noting that the renewed optimism of foreign capital toward Chinese assets is not driven by a single factor. It is the result of the interplay of multiple positive influences. For starters, Chinese assets are currently undervalued, presenting foreign capital with a rare opportunity for strategic positioning.

Second, positive expectations for the Chinese economy continue to bolster global investors' confidence. The Chinese government has implemented a series of stimulus policies to navigate the complex economic landscape both domestically and internationally. The central bank's supportive monetary policy stance and policy orientation has facilitated smoother market liquidity, offering strong support for the real economy. Additionally, proactive incremental policies are consistently yielding dividends, driving economic transformation and fostering high-quality development.

As a result, recent macroeconomic data prove the stabilizing effects of those policies, with signs of improving economic activity.

Furthermore, foreign enthusiasm in Chinese assets is closely tied to the growing openness of China's capital markets. Over the past years, the Chinese government has made great efforts to allow greater foreign access to domestic financial markets.

In November, it released revised rules on foreign investors' strategic investment in listed companies, allowing foreign natural persons to make strategic investment in listed companies. Data from the China Securities Regulatory Commission showed that the number of qualified foreign institutional investors had expanded to almost 858 by November 9, the Xinhua News Agency reported.

Fundamentally speaking, foreign capital's preference for Chinese assets is rooted in a deep understanding of the long-term development trajectories of the Chinese economy. Foreign investors have spotted the significant investment opportunities in the Chinese government's initiatives in promoting structural adjustments, fostering innovation-driven growth.

This is also why, despite the US' recent curbs of investment in some sectors in China, the growth potential and appeal of the Chinese assets remains intact, particularly in emerging industries that attract foreign investors. These sectors, characterized by their unique appeal and substantial growth prospects, continue to draw foreign capital. The allure of the Chinese market is built on a solid economic foundation, a supportive policy environment and an increasingly open capital market. Such market attraction cannot be easily reversed by unilateral political forces.

Even if Washington continues to tighten its curbs on China, international capital has a more objective and positive view of the recovery of China's capital markets and their potential for the future. The Chinese market remains one of the most promising in the world, especially as the Chinese government continues to implement policies to promote the transformation, continuing to open up its capital markets.