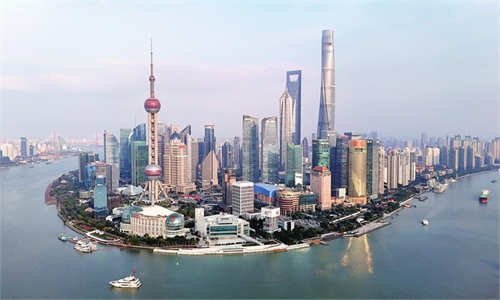

A view of Nanjing in East China's Jiangsu Province Photo: VCG

The annual Central Economic Work Conference (CEWC), held in Beijing last week, crafted specific policies to ensure a steady economic growth in 2025, focusing on high-quality development and fostering new quality productive forces. Multiple foreign enterprises have expressed their confidence in China's economic development prospects next year.

"Based on the CEWC, China's economic work will prioritize scientific research and technological innovation, as well as expanding domestic market demand. The promotion of big-ticket goods consumption, such as new energy vehicles and electronic products, as well as the replacement of old consumer goods for new ones, was highlighted. This favorable climate presents exciting opportunities for foreign companies like Goodyear," Nathaniel Madarang, President of Goodyear Asia Pacific, a tire maker based in Ohio, US, told the Global Times on Sunday.

As the first foreign tire manufacturer in China since 1994, Goodyear is positioned to back up the development of China's automotive sector, particularly the SUV and electric vehicle segments. "Our focus on innovation and sustainability complements China's ambition to foster new quality productive forces which will generate opportunities for closer collaboration with leading auto manufacturers in China," Madarang said.

The important economic meeting said that China should continue to pursue high-standard opening-up and do the country's best to keep foreign trade and foreign investment stable. Efforts should be made to expand opening-up in fields like telecom, health care and education, the meeting stated.

Steadfast opening-up

A signal manifesting China's firm commitment to high-level opening-up, the top financial regulators recently approved German investment firm Allianz Global Investors' stake in Guomin Pension & Insurance Co and allowed US investment bank Goldman Sachs to enter the funds business in China.

In addition, Singapore-based DBS has lately completed a process to increase its stake in DBS Securities (China) Co Ltd to 91 percent, up from 51 percent.

"DBS has profoundly witnessed and participated in China's opening-up since its establishment of a representative office in Beijing in 1993. The move of increasing stakes in DBS Securities (China) is based on our confidence in China's economic prospects in the long run and the policy signal of continuous high-level opening-up. DBS' long-term commitment of firmly exploring the Chinese market and investing in China has never wavered," DBS China told the Global Times in a statement on Monday.

"China will make significant steps in opening-up the economy in 2025," Wei Jianguo, former vice-minister of commerce and executive deputy director of the China Center for International Economic Exchanges, told the Global Times on Sunday.

Wei said that China will accelerate its plan to align its trade practices with high-standard international trade rules, and expand the opening-up in an orderly fashion according to the country's own modernization paces.

Western media outlets highlighted China's opening-up moves. US economic news portal CNBC said in an article on Thursday that the meeting "noted plans to open up China's economy".

Reuters reported that Goldman Sachs' acquisition of a financial license signals Beijing's commitment to further opening up the sector to foreign companies. Bloomberg noted that Chinese policymakers made "lifting consumption vigorously" and stimulating overall domestic demand high on their work agenda, which appeared to be "only the second time in at least a decade."

Confidence in growth

China's economy is projected to grow by around 5 percent this year, contributing nearly 30 percent to global economic growth, Han Wenxiu, executive deputy director of the Office of the Central Committee for Financial and Economic Affairs said on Saturday, at an economic conference held by the China Center for International Economic Exchanges in Beijing.

And, during a meeting with top Chinese officials last week, the heads of major international economic organizations, including head of the New Development Bank Dilma Rousseff, managing director of the International Monetary Fund Kristalina Georgieva, president of the World Bank Group Ajay Banga and director-general of the World Trade Organization Ngozi Okonjo-Iweala, highlighted China's positive role for the global economy.

Amid a slew of global economic challenges and the rise of unilateralism and protectionism, countries around the world are looking to China with a belief that China will remain a key engine of global economic growth, they said, according to the Xinhua News Agency.

At the CEWC, Chinese policymakers reaffirmed their commitment to implementing pro-growth policies by stepping up policy coordination to bolster economic recovery and rebounding.

"We expect a GDP growth target of approximately 5 percent to be set at the Two Sessions in March 2025," Ji Mo, chief China economist at DBS said in a note sent to the Global Times at the weekend, noting that "such a target would signal confidence."

By adopting a balanced approach to coping with short-term challenges and long-term structural adjustments, China is expected to sustain stability, resilience, and growth in an increasingly complex global environment, Ding Shuang, chief economist for Greater China and North Asia region, Standard Chartered Bank, told the Global Times.

Looking ahead to 2025, China's domestic demand will continue to improve, and confidence of foreign businesses in China's massive market is expected to rise, KPMG China said in a report sent to the Global Times.

In the first 11 months of this year, 52,379 new foreign-invested enterprises were set up nationwide, an 8.9-percent increase year-on-year, latest data from the Ministry of Commerce revealed on Saturday. And, the proportion of actual use of foreign direct investment in China's high-tech manufacturing sector rose 0.3 percentage points from a year earlier.

"China's huge market potential and its key position in the global supply chain still attract a large number of foreign investors to maintain and increase their presence in the Chinese market," KPMG said.