The US should not be a disruptor of global chip industry recovery: Global Times editorial

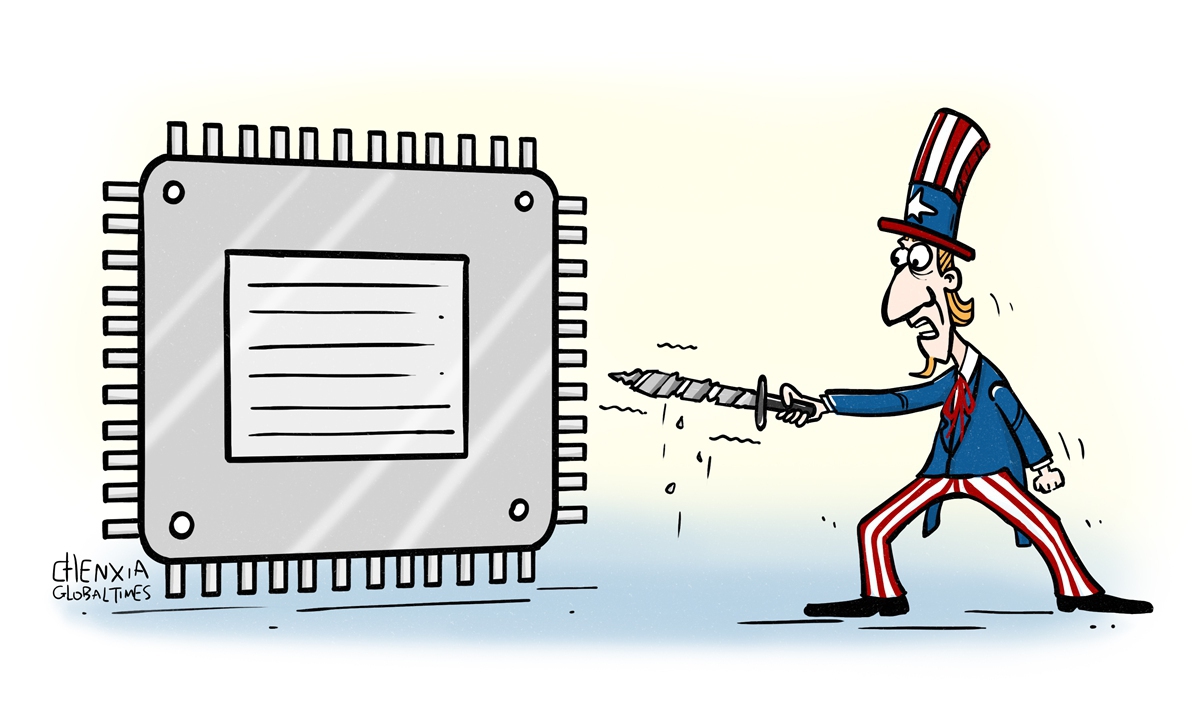

Illustration: Chen Xia/GT

As the year comes to a close, China's cooperation with the global semiconductor industry is witnessing a series of positive developments. Semiconductor giants such as Infineon, NXP and STMicroelectronics have announced plans to continue expanding their presence in China, including setting up new production lines or collaborating with Chinese companies to manufacture chips. Semiconductor companies from Japan and South Korea have also expressed their intention to increase chip procurement from China this month, with the goal of building a strong supply chain. In addition, data shows that from January to October this year, China's semiconductor exports reached 931.17 billion yuan ($128 billion), an increase of 21.4 percent year-on-year, making it a major highlight of this year's overall export performance.

At the same time, the US has also frequently interfered with the normal order of the global semiconductor supply chain. Earlier this month, the US Department of Commerce introduced a new round of export controls on China's chip industry.

Following that, several foreign media outlets revealed that the US government may continue to implement restrictive measures from multiple angles and dimensions, including restricting the sale of advanced AI chips in Southeast Asia and the Middle East, as well as launching trade investigations into China's older-model semiconductors. This has already triggered concerns and resistance within the global supply chain. A recent report in The New York Times revealed that there is an "intense struggle" between US companies and officials over semiconductor restrictions on China. The stance indicates that these US enterprises are sober-minded.

While the US is "building walls," China is "building bridges." This is the reality facing countries and businesses worldwide. Although the US frequently uses China as an excuse for its protectionist measures, other countries see the situation clearly: US' fundamental goal is to maintain its absolute dominance in the technology sector, even if sitting at the same table, others' chairs must be a notch lower.

However, the semiconductor supply chain is akin to a living organism, and its current globalized form is the result of natural growth. The journey of a chip from concept to design and development, and finally to packaging as a finished product, relies on the coordination and cooperation of multiple countries along the industry chain. Attempting to implement "decoupling" in such an interconnected system goes against the laws of market and undermines the shared interests of all nations involved in the industrial chain.

Although the US increasingly emphasizes its so-called "supply chain security," other countries and businesses view "decoupling," along with protectionism, as the true sources of man-made risks. This also explains why global semiconductor giants are continuing to expand their presence in China. Beyond the progress China's semiconductor industry has made in talent, technology, and other areas, key factors include China's stable policies of opening-up and its strong willingness to collaborate internationally. Investment and cooperation in the semiconductor industry are long-term endeavors, where stability and predictability are the top priorities for businesses.

In fact, only by stepping out of the narrow perspective of "technological competition" to observe the development of China's high-tech industry can we truly understand the inevitability of this progress. In recent years, the vigorous development of emerging industries in China has attracted global attention. The entire chain of research, production, and sales of new energy vehicles is active, with various supporting electronic systems such as control, radar, and entertainment interaction continuously being upgraded. Industries such as drones and smart home appliances have also experienced rapid growth. These products require basic functions of computation and information processing, creating a vast development space and urgent market demand for the entire semiconductor industry.

In other words, the growth of China's semiconductor industry aligns with and responds to the country's level of industrialization and informatization, educational standards, and the need for its own industrial upgrading. At the same time, it meets the current global demands for technological inclusiveness, diversified supply, and detailed industrial division of labor.

Currently, from the perspective of the global semiconductor industry landscape, the US remains the largest player, holding over 40 percent of the global market share. Meanwhile, China has made a lot of progress in recent years and is expected to account for around 30 percent of the global market share this year. This does not imply a zero-sum relationship between China and the US. In fact, 40 percent of the sales of American semiconductor manufacturing equipment companies depend on China. One important factor that enables US companies to take the initiative in market competition is their high investment in research and development, which requires market support. If China, the largest single market for semiconductors globally, were to be "excluded" from the financial statements of these companies, it would not only be impractical but would also inevitably undermine the competitiveness of the industry.

As a highly internationalized industry, the development of the chip sector requires open cooperation rather than closed confrontation. Since the beginning of this year, the global semiconductor industry has experienced a strong rebound, with China being both a leader in the industry's recovery and a promising destination for other countries and companies seeking collaboration and opportunities.

The Chinese advanced chip industry still faces many challenges, but the world has witnessed its strong momentum of development despite being contained and suppressed. More importantly, China is contributing to the global semiconductor industry and looks forward to collaborating with companies from around the world.