US dollar uncertainty prompts economies to heighten vigilance against spillover risks

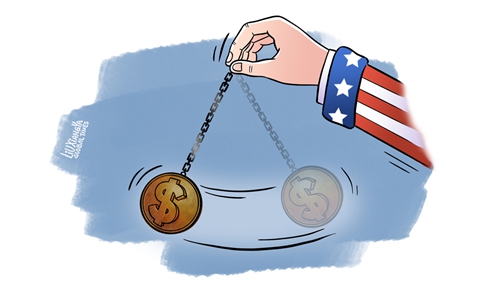

Illustration: Liu Xiangya/GT

As 2025 begins, the future of the US dollar has become a focal point of intense discussion within the global financial community. After an impressive 7 percent rise in the dollar index in 2024, traders are now evaluating the possibility of continued strength in the currency. On Thursday, the dollar eased slightly, dipping 0.2 percent to 108.32, Reuters reported, although it remained near a two-year high, underscoring the persistent uncertainty surrounding currency markets. This fluctuation reflects the complex forces at play. While the dollar's immediate future remains uncertain, its movements continue to exert a powerful influence over global trade and investment decisions, particularly in terms of the potential risks it may pose to emerging markets.Economists remain divided on how long the dollar's strength will persist. While some remain cautious about its ability to maintain its upward momentum, a report by news portal wallstreetcn.com shows that most of Wall Street's leading banks predict the dollar will stay robust. A team from Goldman Sachs wrote in a November report that "the dollar will be stronger for longer," as cited by Bloomberg. They pointed to a potent combination of tariffs, a booming economy and rising US asset prices as factors supporting the dollar.

While this outlook offers hope for remaining bullish on the dollar, it also raises concerns over the ripple effects on emerging markets. A stronger dollar could exacerbate financial risks and add strain to economies already grappling with currency devaluation.

As the interest rate gap between the US and other economies narrows, some emerging market currencies have experienced varying degrees of depreciation. As reported, the MSCI emerging markets currency index has shown a decline in the fourth quarter of 2024, with countries such as Brazil drawing attention due to their weakening currencies against the US dollar.

If the US dollar strengthens further, some emerging markets could face a dual threat: capital outflows and escalating external debt burdens. A stronger dollar tends to drive investors toward higher returns in US assets, which exacerbates capital flight from these markets. This outflow not only weakens local currencies but also reduces liquidity for multinational corporations. Moreover, some emerging economies carry dollar-denominated debt, and as the dollar appreciates, the cost of servicing this debt rises. For nations already burdened by external debt, a stronger dollar makes repayment more expensive, intensifying their financial vulnerability.

The continued strength of the US dollar presents particular risks for certain emerging economies already grappling with external and fiscal imbalances. Countries with large current account and fiscal deficits, coupled with low foreign exchange reserves, are especially exposed to the negative consequences of a stronger dollar. This can set off a vicious cycle of currency devaluation, capital outflows and rising debt service costs, underscoring the need for vigilance in managing the financial risks that uncertainty regarding the US dollar poses to emerging markets.

In recent times, China's yuan has experienced a modest depreciation. Yet, one thing remains clear: China is more than capable of navigating the uncertainty surrounding the US dollar and any potential spillover effects in 2025. At the heart of the yuan's value is the strength of China's economic fundamentals. The country's economy continues to outpace global averages in terms of growth, with an ever-clearer focus on high-quality development. This emphasis on sustainable, high-quality growth bolsters the long-term outlook for the currency, instilling confidence in both domestic and international markets.

China has gained experience from past episodes of volatility, refining a robust set of policy tools to help stabilize the market and prevent imbalanced expectations from taking root. The nation's vast foreign exchange reserves - impressive not only in scale but also in quality - further enhance confidence in the yuan's stability.

China never manipulates its currency, but the country is well-equipped to ensure the long-term stability of its currency, providing a stable and reassuring environment for investors and contributing to the financial stability of emerging markets at large.

The author is a reporter with the Global Times. bizopinion@globaltimes.com.cn