Illustration: Chen Xia/ GT

In a striking display of economic nationalism, US President Joe Biden blocked Japan's Nippon Steel from acquiring US Steel in a $14.9 billion deal, citing "national security" concerns and the need to safeguard critical supply chains.

This decision, made in the twilight of the current US administration, is more than a rejection of foreign investment; it's a declaration that the US industrial backbone is not for sale, even to its closest allies.

Steel, the lifeblood of infrastructure and military might, is not just another commodity. It's the foundation of the US' bridges, tanks and skyscrapers - essential to national security, just like soldiers and satellites. This underscores the strategic significance of the Biden administration's decision.

By keeping US Steel in American hands, the Biden administration has drawn a line in the sand, signaling that specific industries are too critical to be controlled by foreign entities.

The statement from Biden reads: "Without domestic steel production and domestic steelworkers, our nation is less strong and less secure." This sentiment resonates deeply in a country where the decline of manufacturing has left scars on communities and fueled political populism.

The Biden administration's move aligns with its broader commitment to protecting American jobs and industries - a promise that has garnered bipartisan support, with even his successor echoing similar sentiments. However, this isn't just about economics; it's about geopolitics.

By rejecting Nippon Steel's bid, the US is also intensifying its efforts to maintain independence in industries where China's influence looms and attempting to strengthens its position in the ongoing economic rivalry with China.

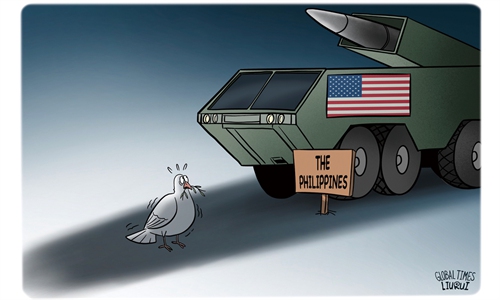

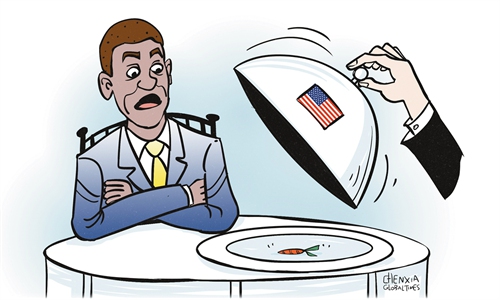

For Japan, Biden's decision is a bitter pill to swallow. Nippon Steel had promised it would not cut output capacity at US Steel's mills for 10 years.

The Japanese company's pleas are in vain; Washington fundamentally treats Tokyo as a subordinate. How could a subordinate be allowed to control America's strategic industries?

The implications extend beyond Japan.

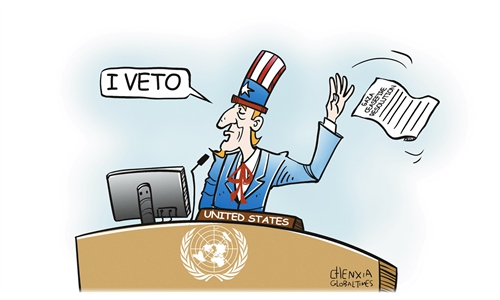

US allies, including the EU, are watching closely. The Biden administration's move reinforces a growing perception that the US is prioritizing its own economic security over the interests of its partners. This could strain alliances and push countries like Japan, as well as EU members, to seek closer economic ties with other nations.

Washington's protectionist stance may accelerate the regionalization of the global economy. Countries excluded from US markets could double down on regional trade agreements like the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) or the Regional Comprehensive Economic Partnership (RCEP). These agreements, which exclude the US, could become platforms for countries to reduce their reliance on American markets and forge new economic alliances.

This could lead to a more fragmented global economy, with regional blocs becoming increasingly economically self-sufficient.

As the US raises barriers to foreign investment, China could position itself as a more reliable partner for countries seeking to diversify their economic relationships.

While the Biden administration's decision may protect American jobs and industries in the short term, it carries long-term risks. By shutting out foreign investment, the US could miss opportunities to modernize its industries and strengthen its global competitiveness. Moreover, protectionism could erode the country's leadership in the global economy as other countries turn to alternative markets and partners.

As the dust settles, one thing is clear: Resistance to US protectionist policies could push the world toward a more multi-polar economic order.