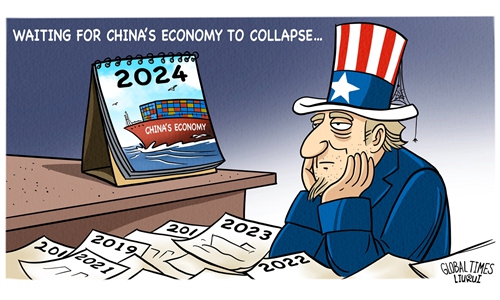

Illustration: Liu Rui/GT

Some Western media outlets have long sought to twist public perception about the Chinese economy by emphasizing the negative factors and presenting one-sided perspectives.The latest example is an article published on Monday by The Wall Street Journal, headlined "China Must Heed Lessons of Japan's Lost Decades," which said that yields on Chinese government bonds plunged to multidecade lows, indicating expectations of lower growth down the road. "That draws an uncomfortable parallel to Japan, which was mired in decades of deflation," it said.

The 10-year Chinese government bond yield fell below 1.6 percent on Friday, reaching a record low of 1.58 percent.

Western media outlets repeatedly use the logic of traditional Western economics to explain the economic challenges currently faced by China, lacking a true understanding of the actual situation of China's economic development. Such biased and misunderstood judgments will eventually be proved wrong by the reality of China's development. While the recent slide in the yields of Chinese government bonds seems to indicate investors' preference for safe-haven assets amid pessimistic expectations, this does not mean that the Chinese economy is heading toward the same situation as Japan's stagnation in 1990s.

There are significant differences between the two economies. The fundamental strengths of the Chinese economy, along with the government's substantial capabilities and tools to ensure long-term economic development, provide crucial support for stable growth.

Historically, the lowest level of the 10-year government bond yield occurred in April 2002, when it briefly fell below 2 percent. At that time, the decline in the yield was primarily driven by the repercussions of the 1997 Asian financial crisis, which led investors to adopt a pessimistic outlook on future economic trends.

However, despite that bearish sentiment, China's economy grew by 8 percent in 2002 and 9.1 percent in 2003, suggesting that the drop in government bond yields may have reflected downward pressure on the economy but not the true situation of future economic performance.

The recent round of declines in government bond yields can be attributed to multiple factors, including but not limited to monetary policy, inflation expectations, dynamics in international financial markets and investors' risk preferences. In particular, geopolitical pressures have led investors to prefer allocating funds to relatively safe assets, such as government bonds.

Moreover, China's central bank has outlined its monetary and financial priorities for 2025 following a two-day meeting that ended on Saturday, explaining that it will implement a moderately loose monetary policy to create a sound monetary and financial environment for stable economic growth, according to the Xinhua News Agency. An increase in liquidity typically leads to higher demand for government bonds, rising prices, and falling yields.

The Chinese economy is indeed grappling with various challenges, such as pressure from industrial structural adjustments and a complex international trade environment. But China's situation is fundamentally different from the economic stagnation of Japan in the 1990s. Although China's economic growth has slowed from its previous high rates, the decline is significantly less than Japan's economic trajectory.

Japan's GDP growth rate slowed to 0.8 percent in 1992. From 1991 to 2002, real GDP growth averaged 1 percent per year. By contrast, China's economic growth rate is expected to have stabilized in 2024, still surpassing that of most developed economies globally.

More importantly, China's emphasis on stabilizing the economy in 2025 is clear. The Central Economic Work Conference held in December signaled that more proactive and impactful macro policies should be implemented to sustain the upward trend of the economy.

Also, the Chinese government remains equipped with sufficient macroeconomic control tools. With a well-stocked toolbox, the government is fully capable of fostering stable and healthy economic development through a series of targeted and effective macro-support policies.

These include strategic adjustments to fiscal policies, the optimization of industrial structures, and the deepening of reforms and opening-up initiatives. By leveraging these tools, the government can not only navigate current economic turbulence but also lay a solid foundation for sustainable growth.