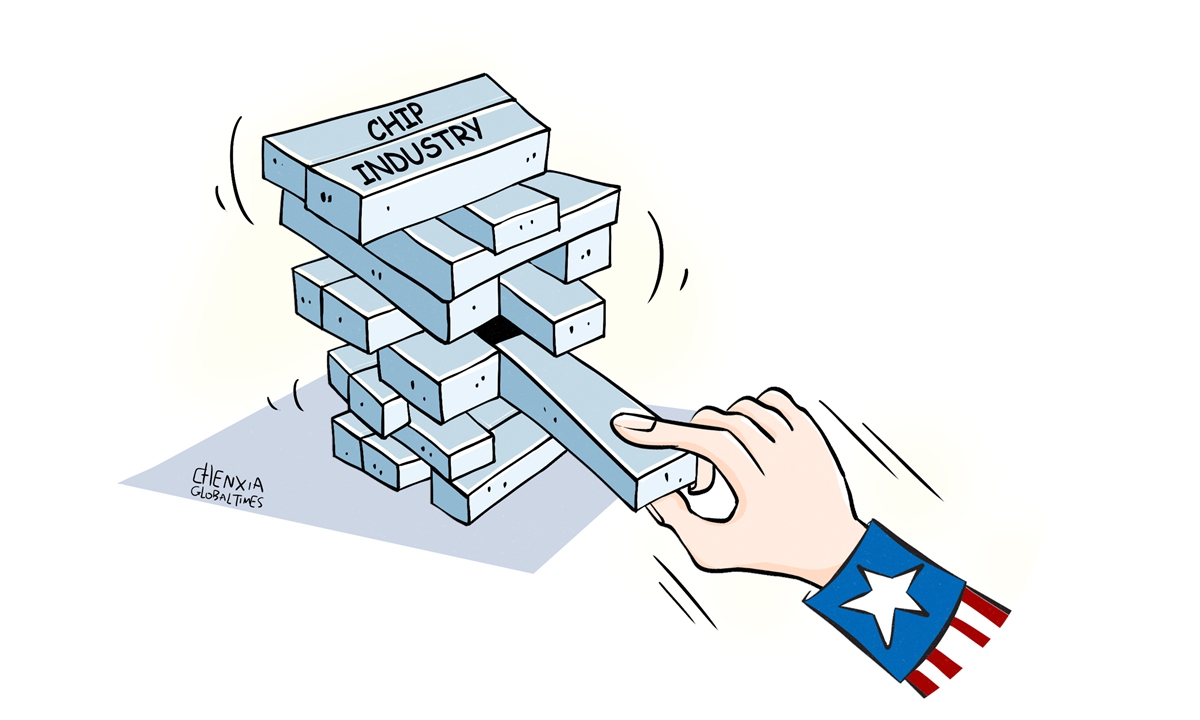

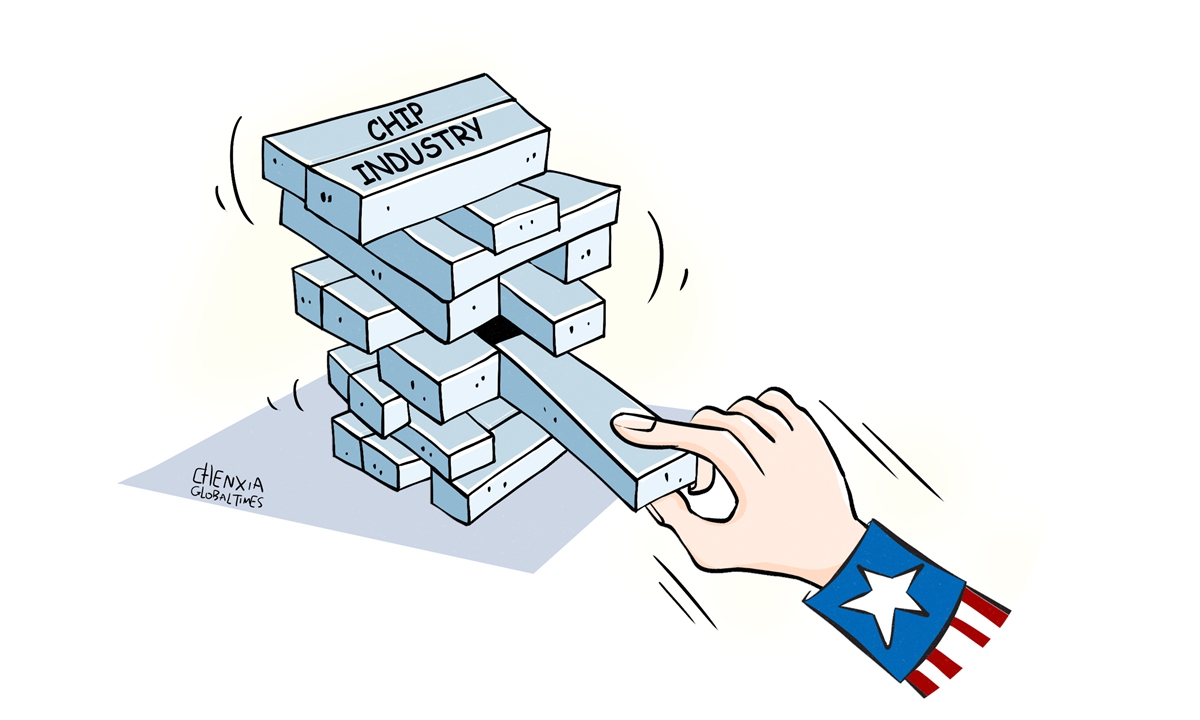

Illustration: Chen Xia/GT

The US' CHIPS and Science Act, which has long been touted as a major move to boost the US' domestic chip industry, appears to be at a crossroads. US Commerce Secretary Howard Lutnick has signaled he could withhold promised grants as he pushes companies in line for federal semiconductor subsidies to substantially expand their US projects, Bloomberg reported on Tuesday, citing eight people familiar with the matter.

Just a day earlier, on Monday, the new US administration reportedly set up a new entity to take over the CHIPS Act program, adding to increasing signs suggesting that the future of this act could be shrouded in uncertainty.

However, the uncertainty surrounding the act does not imply that the US will diminish efforts to bolster its domestic semiconductor industry and contain the rise of foreign competitors. Bloomberg reported that Lutnick has expressed interest in expanding a separate 25 percent tax credit from the CHIPS Act. It appears that direct funding awards are being marginalized, indicating a possible shift in the strategic direction of US semiconductor policy.

As of now, there is insufficient information available to fully comprehend the intricacies of the new US administration's policy on semiconductors. The potential for shifts in policy direction adds a layer of uncertainty.

One potential scenario is that Washington may intensify its intervention in the global semiconductor supply chain. CNN reported in February that the US administration was eyeing a "25 percent or higher" tariff on all semiconductor chips the US imports. A conceivable development could be that, alongside a transformation in US chip policy, it will likely exert additional pressure on the global semiconductor industry, which could further disrupt the global supply chain.

For other countries in the supply chain, including China, this scenario is not unfamiliar. In recent years, despite facing some challenges, the global semiconductor supply chain has demonstrated overall resilience. Some emerging market countries have set their sights on developing their semiconductor industries. China, in particular, has seen rapid development in this area. Regardless of how the US alters its semiconductor policy, introducing uncertainty into the global semiconductor supply chain, China has found a path that suits its own development.

The Global Times wrote in an editorial last year that the core logic of China's response to suppression and containment in the technology sector has always been self-reliance and self-strengthening. This point remains unchanged.

Despite facing technological suppression and chip export restrictions from the US, China's chip industry has demonstrated strong resilience and growth in recent years. This strong development trend has been driven by several factors, including policy support, market demand and technological advancements.

The semiconductor market in China has significantly increased, making it the world's largest for several consecutive years, according to information from industry group SEMI. Strong market demand has provided significant momentum for the development of the semiconductor equipment industry.

Technological advancements continue, particularly in equipment manufacturing. The industrial landscape is also evolving, characterized by the formation of industrial clusters and enhanced collaboration within the supply chain.

China's semiconductor market is poised for further growth, driven by sustained market demand, ongoing technological innovation, supportive policies and enhancements in domestic capacity. These factors present abundant opportunities for foreign enterprises seeking to engage with this dynamic market.

China, Japan and South Korea have reached a consensus to strengthen cooperation on supply chains and dialogue on export controls, Yuyuantantian, a social media account affiliated with China Media Group, reported on Monday. Japan and South Korea hope to import some semiconductor raw materials from China, while China hopes to import chip products from Japan and South Korea. There is a common understanding among China, Japan and South Korea to maintain smooth supply chains in these areas, according to the report.

As the US deliberates tariffs, China is advancing international cooperation. While US protectionist policies often cite China as the pretext, it's clear to other countries that its real objective is to preserve American dominance in the technology sector. Despite uncertainty being exported by the US, there is no need for excessive worry, as long as other countries in the supply chain focus on development and cooperation.

The author is a reporter with the Global Times. bizopinion@globaltimes.com.cn